“Poli talks” continue as investor headache

Many investors dream about having less of the tough political rhetoric and macroeconomic interference, but the reality looks different.

Very respectable and fine organisations like The International Monetary Fund (IMF) have throughout the year revised their global GDP growth forecasts lower. The reason is not just a downswing in economic activity; this can happen, but also very much linked to barriers in global trade.

It’s been a pretty long time ago since the world economy has truly suffered in that way, from a trade war, like the current one between the US and China. Other factors also play a role, as IMF is pointing at, like the unsolved Brexit chaos and the trade frictions between Canada, Mexico, and the US.

Though without any doubt, the clash between the two economic superpowers is seen as the key to the current global economic slowdown. This is also how I assess the general view in the financial markets.

It could lead to the thinking that if Washington and Beijing could solve their controversy, the Brexit can come under control and this sweet cocktail would be topped with some fiscal spending here and there, then the bright world is back on track.

Surely, it would be nice if the world woke up to this sunshine tomorrow, and I am certain that the stock markets would jump about 10 pct. in such case.

The good part about this wishful thinking is that it is actually possible. To make it happen, it just requires some people and governments to agree, and then the world is back on track- well, almost.

This outcome is not impossible at all, and for 12 months ago, it was probably the most likely scenario. It remains my primary scenario that the US and China will find an agreement in December or January. If that would be the case, then it’s a solution that will make the world happy again, at least for a period. I would not expect the deal to be long-lasting, and the dispute will return some day.

Should some sort of agreement come in place between the two countries, then I argue that it will probably underline that global trade and global growth is moving towards a shift again. In a world with limited economic growth, it will revive the tensions, or at least change the playground for investors, which in itself is a challenge.

The reality is that an agreement between the US and China is not enough to rescue the world from a global economically squeezed situation anymore.

Since the global financial crisis, the rhetoric from a growing number of political leaders has become tougher. As a consequence, the macro economic thinking has become more domestic-focused and protective. American President Trump is the most profound example. My assessment is that many in the financial markets have for long, believed that the period with Trump would be four years, after which, global life would swing back to “normality”.

The current discussion about a Trump impeachment inquiry includes the possibility that the President’s future can change. Though, I’ve noticed how many analysts in the financial markets consider it likely that President Trump will also win the next term. Currently, he is behind in polls against leading Democrats, but several analysts don’t trust that even the most likely Democratic candidates can prove to be a strong alternative to Trump.

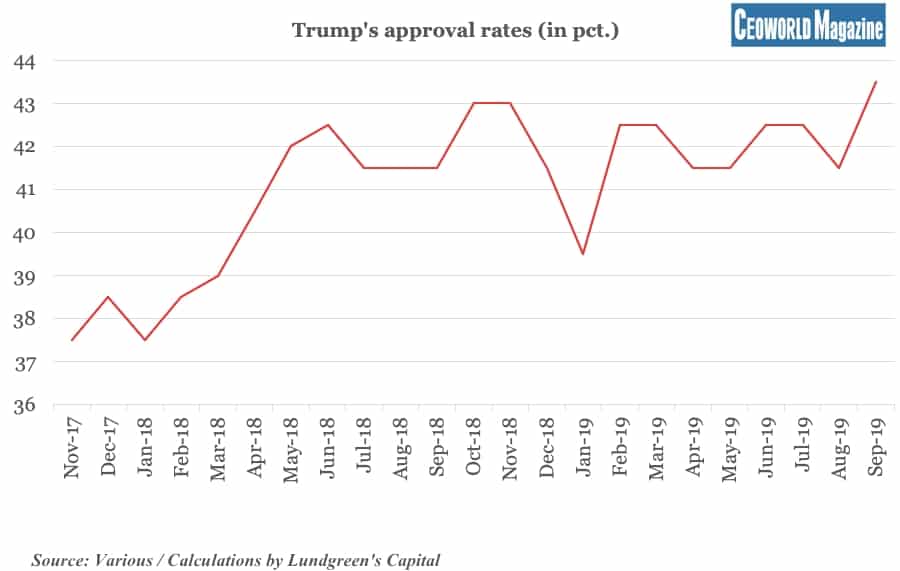

Further, I argue that President Trump is very much focused on his approval rates, and they have been rising during the past two years, now standing at 43,5 pct. For Trump, this confirms that he is doing the right thing, and acting as his electorate is expecting.

Even with some sort of agreement with China, I expect Trump to continue the tough rhetoric. And the American government is partly right, that the WHO trade agreement is outdated, as it was negotiated in the mid-1990s, so it should be amended to current conditions. This view could also very well be taken over by a possible democratic American president, though delivered with another rhetoric.

As the outlook for global growth is weak, then I asses that a growing fight about trade and GDP growth is more likely, rather than just smoothly moving back towards the rosy picture described earlier. This is a true challenge for investors, and corporations, because it gets tougher to judge the future political behaviour and how the rhetoric firearms will be used.

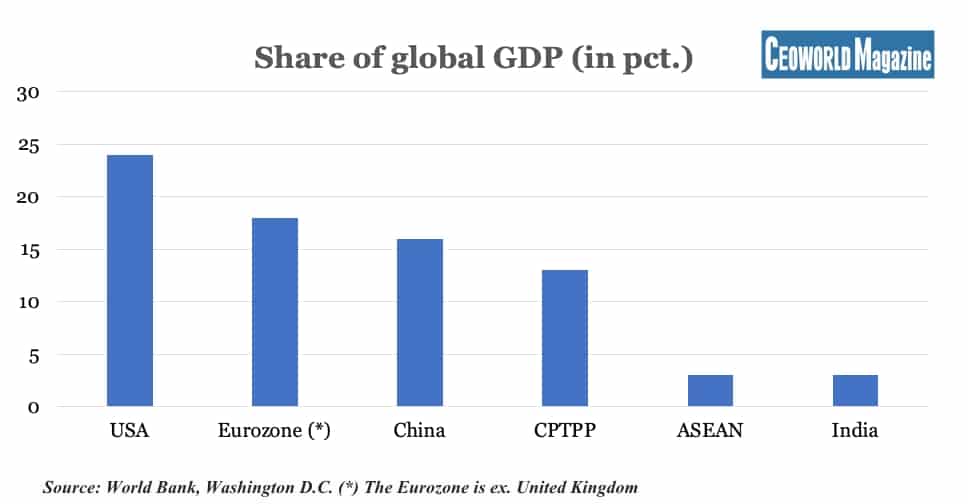

Growing protectionism is an obvious increasing risk and I am very convinced that the focus on domestic growth will intensify further, though also to grow economic single markets or free trade zones. Graphic two shows the trade zones/single markets that I consider to be the most important and interesting. In total these represent 77 pct. of global GDP where I regard US and China as the world’s two dominant zones/single markets going forward, with the Eurozone as the fading star.

My primary scenario is that future GDP growth is concentrated on these two leading zones when measured by power and size. The ASEAN Group has the best opportunity for the highest growth rate, though I do not trust that the CPTPP group of countries (The Comprehensive and progressive Agreement for Trans-Pacific Partnership) will create the necessary growth momentum, as half of CPTPP’s GDP origin are from Canada and Japan.

However, my expectation is that each group/economic zone will try to develop their internal free trade further and therefore, the various groupings are increasingly interesting, depending on what one as an investor is looking for.

However, one thing seems obvious- to understand and spend time on the US-China development. But for the time being, I do not expect the “world” to improve, meaning, investors and corporations will have to accept the current global political scene as a frame condition.

Graphic one: Trump’s approval rates (in pct.)

- Nov-17: 37,5%

- Dec-17: 38,5%

- Jan-18: 37,5%

- Feb-18: 38,5%

- Mar-18: 39%

- Apr-18: 40,5%

- May-18: 42%

- Jun-18: 42,5%

- Jul-18: 41,5%

- Aug-18: 41,5%

- Sep-18: 41,5%

- Oct-18: 43%

- Nov-18: 43%

- Dec-18: 41,5%

- Jan-19: 39,5%

- Feb-19: 42,5%

- Mar-19: 42,5%

- Apr-19: 41,5%

- May-19: 41,5%

- Jun-19: 42,5%

- Jul-19: 42,5%

- Aug-19: 41,5%

- Sep-19: 43,5%

Graphic two: Share of global GDP (in pct.)

- USA: 24%

- Eurozone*: 18%

- China: 16%

- CPTPP: 13%

- ASEAN: 3%

- India: 3%

*The Eurozone is ex. United Kingdom

Have you read?

The World’s Safest Cities Ranking, 2019.

The Best Hotels In New Delhi For Business Travelers, 2019.

Best CEOs In The World 2019: Most Influential Chief Executives.

Countries With The Best Quality of Life, 2019.

World’s Best Countries To Invest In Or Do Business For 2019.