One of my “daily reads” is Business Insider. It is comprehensive, constantly updated, and deals with business, culture, news… so much.

Recently, I read two articles that are especially worth noting.

One was a piece by Fran Tarkenton, former NFL quarterback, now successful entrepreneur. His article was about “big” companies getting in trouble: Businesses Like McDonald’s And Sears Are Getting Complacent — Here’s Why It’s A Problem. Here’s a key paragraph:

When any entity becomes dysfunctional, it all boils down to the same root causes: a blame game where nothing gets done, and everyone getting locked into complacency about the way things are.

And a key to not becoming complacent, for Mr. Tarkenton, is to read – constantly:

Reading is key

The only way to force disruptive thinking, the essential ingredient for innovation and reinvention, is to go out and grab it. You have to read more, you have to seek out more diverse ideas, and you have to ask more questions.

I read all kinds of different things. Every day, for example, I read The New York Times, which leans liberal, and The Wall Street Journal, which leans conservative. I read business journals and science blogs, newsletters and stock prospectuses. I read articles my friends send me. Some of what I read is in my comfort zone, but I also read a lot of things I don’t know much about, giving me a different perspective that I never would have thought of on my own. In short, I’m looking for the best thinking no matter where it comes from.

(He tells a great story about a 14 year old reader of boxes and labels at the store where he worked. Great story!).

So, keep reading.

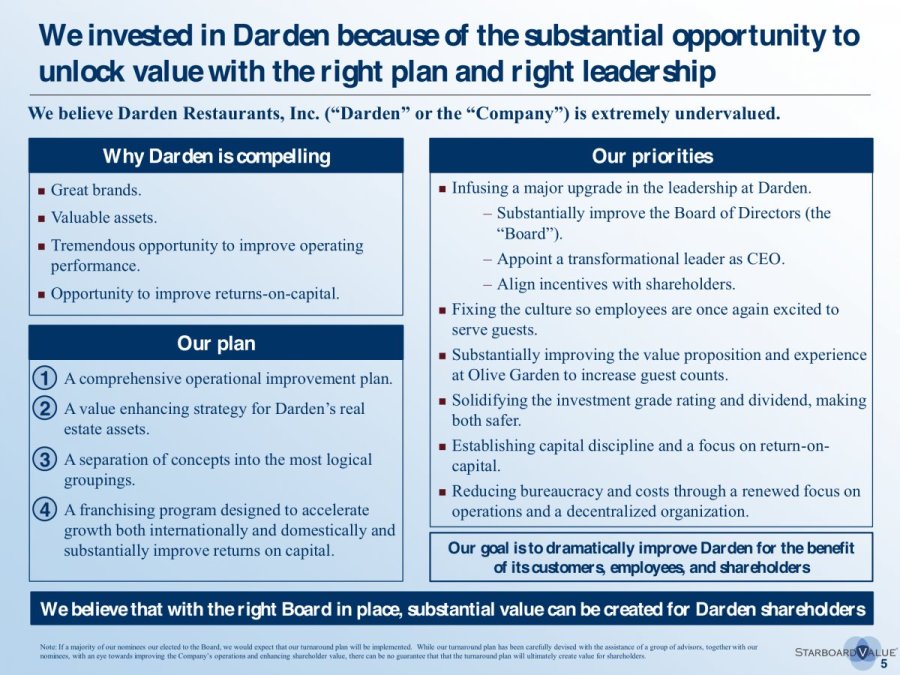

The second article, Hedge Fund Manager Publishes Dizzying 294-Slide Presentation Exposing How Olive Garden Wastes Money And Fails Customers, included the full slide 294-slide presentation by Starboard Value, a hedge fund that owns about 8.8% of the Olive Garden owner Darden Restaurants, outlining ways the company can make more money.

Here’s one slide from the slide deck:

And here’s the line that jumped out at me (from this slide):

Fixing the culture so employees are once again excited to serve guests.

The slide deck includes many specifics, including a mistake about not putting salt into the cooking pots for the pasta, what to do about no-longer-edible bread sticks, and even thoughts about corporate headquarters. But, thinking about the big picture, the entire presentation calls for a change in culture.

Now, I know enough about corporate culture to know this – changing one is very, very difficult. Changing culture successfully throughout many locations, with thousands of employees, sounds practically impossible. But this hedge fund provides many concrete steps to try to do just that.

Here’s the hidden-in-plain-sight takeaway – if the success of an organization matters to you (like it does to a highly invested hedge fund), then it’s time to look at every single detail you possibly can, and constantly ask, with attention to every detail:

What are we doing right?

What are we doing wrong?

How do we fix things?

These are two good reads from Business Insider.