While I have voiced concern that entrepreneurship has become too enthralled by the wants of venture capitalists and are therefore more concerned with lucrative acquisitions than in actually running a successful business, it would nonetheless be churlish to diminish the important role the sector plays in supporting early-stage businesses.

Recent research from Invest Europe suggests that the VC industry in Europe is in rude health. Indeed, record levels of funding were secured during 2021.

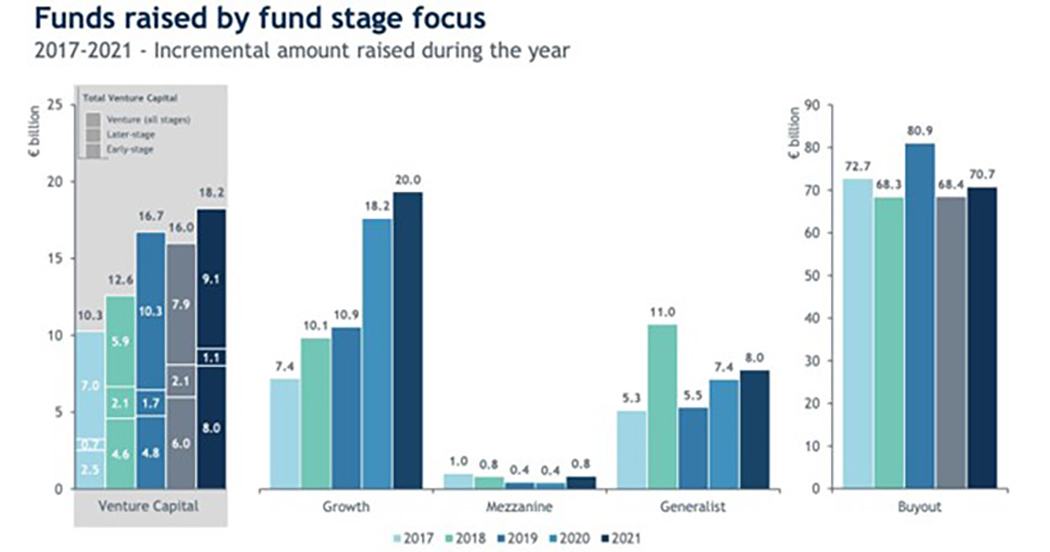

“Total fundraising in Europe during 2021 reached €118bn, 7% above 2020’s figure and the highest level ever recorded,” the authors say. “A record number of 841 funds raised capital during the year, the highest number of funds recorded ever.”

Record levels

Tech businesses were far and away the most successful at raising funds, with these startups harvesting 37% of all investments. When biotech/healthcare and consumer goods were added in, these three sectors accounted for around two-thirds of all investments. Indeed, the growth in healthcare funding was evident since the start of the pandemic, with medtech startups securing 15% of all investments.

“60% of equity invested was domestic (within the country), 33%

was intra-European, and 6% from non-European sources,” the authors explain. “Investments (by number of companies) were concentrated in four sectors: ICT (37%), consumer goods & services (17%), biotech & healthcare (15%), and business products & services (13%).”

The report reveals that over 5,300 companies received investment during 2021, of which 98% were SMEs. The lack of route to market was also evident in the data, however, with over two-thirds of exits occuring either through acquisition by another private equity firm or a trade sale to a larger rival. There has long been a concern that the large number of startups being acquired by larger rivals rather than floating and maintaining their independence is a key factor in the stagnating rate of innovation in recent years.

Whether the sector continues its growth during 2022 as interest rates rise and the flow of cheap money dries up remains to be seen. For now, however, the industry appears in rude health.

“The data is proof that private equity and venture capital are an essential part of the European investment universe, providing capital and support for companies, both to weather tough conditions and to seize opportunities in fast-moving European markets,” said Eric de Montgolfier, Invest Europe CEO.