5 Ways to Finance a Car: Their Pros and Cons Compared

Strategy Driven

NOVEMBER 20, 2023

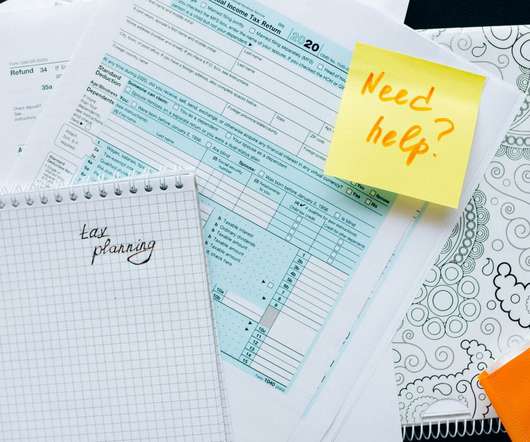

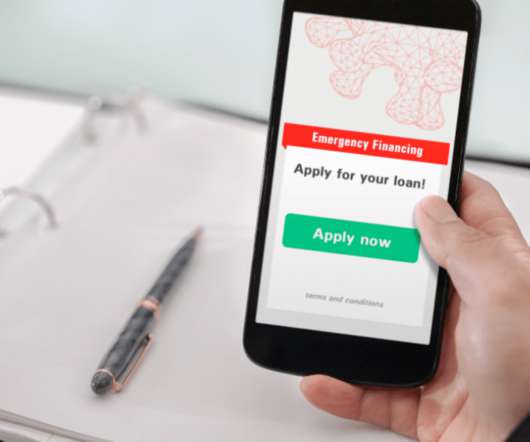

To make reliable transportation affordable, most buyers turn to some type of financing. Traditional Auto Loans If you have decent credit and a down payment, you can get a traditional auto loan. If you make your payments on time, these loans will improve your credit score. You put about 10% down, then make your monthly payments.

Let's personalize your content