Why Today’s Leaders Need to Be Perpetual Learners

Harvard Business Review

AUGUST 11, 2023

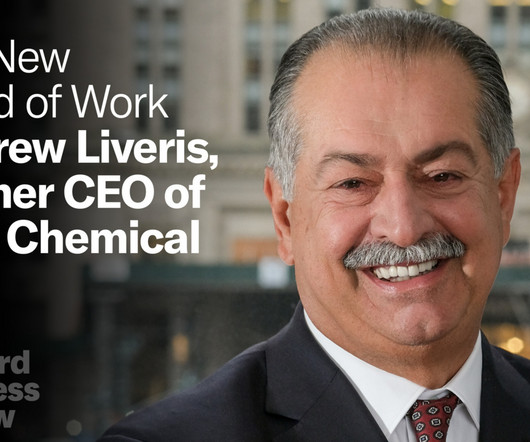

Born to immigrant parents in the Australian outback, he would eventually rise to the top of the corporate world, taking over in 2004 as CEO of Dow Chemical. In that job, which he held for 14 years, he won widespread credit for pushing an ambitious sustainability agenda, no easy task at one of the world’s biggest chemical producers.

Let's personalize your content